On july 1, 2022, the gsa announced the mileage reimbursement rate will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1, 2022. Effective january 1, 2024, state travel reimbursement rates for lodging and mileage for automobile travel, as well as allowances for meals, shall be set at the maximum rates established by the federal government for travel expenses, subsistence expenses, and.

What Is The 2024 Irs Mileage Reimbursement Rate Connie Constance, Are employers required to pay for mileage in illinois? Fy 2024 travel guide updates.

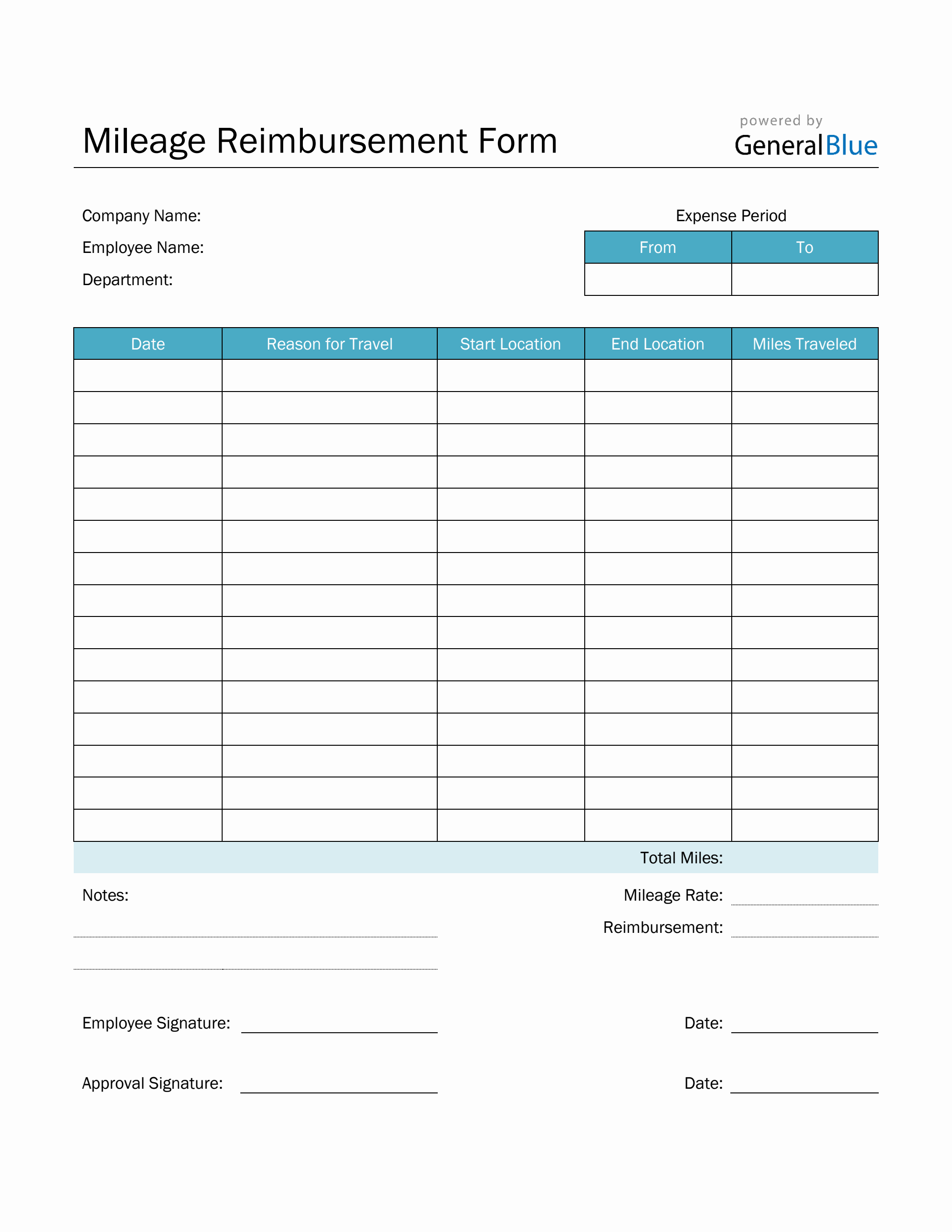

Mileage Reimbursment 2024 Minna Sydelle, In this article, we will answer fundamental questions, including: Use this table to find the following information for federal employee travel:

Mileage Reimbursement Rate For 2024 Karyn Marylou, Discover everything you need to know about illinois mileage reimbursement law. On july 1, 2022, the gsa announced the mileage reimbursement rate will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1, 2022.

Illinois Mileage Rate 2024 Bili Mariya, 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. Fy 2024 travel guide updates.

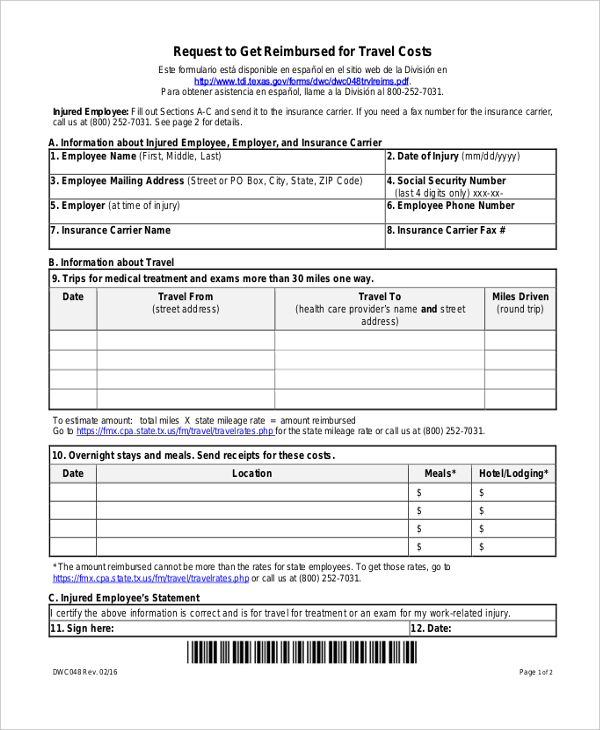

Workers Comp Mileage Reimbursement 2024 Amity Beverie, What is the illinois mileage reimbursement. On january 1, 2024, the gsa announced that the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile effective january 1, 2024.

2024 Irs Mileage Reimbursement Rate Coral Karola, Most employers do pay travel. On july 1, 2022, the gsa announced the mileage reimbursement rate will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1, 2022.

Reimbursement Rate For Mileage 2024 Belita Annemarie, On january 1, 2024, the gsa announced that the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile effective january 1, 2024. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

What Is The 2024 Mileage Reimbursement Rate Janey Lisbeth, Fy 2024 travel guide updates. According to the illinois wage payment and collection act, illinois is one of three states that.

2024 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, You are not eligible to be reimbursed for mileage. According to the illinois wage payment and collection act, illinois is one of three states that.

Il Mileage Reimbursement 2024 Ambur Bettine, Code sections 3000.300 (f) (2) and 2800 appendix a, reimbursement for use of a private vehicle while traveling on official government business shall be on a mileage. Discover everything you need to know about illinois mileage reimbursement law.

On july 1, 2022, the gsa announced the mileage reimbursement rate will increase from 58.5 cents per mile to 62.5 cents per mile effective july 1, 2022.